This article tries to trace the need, purpose, origin, evolution, and effectiveness of the concept of Independent Directors in India.

THE NEED – AGENCY PROBLEMS

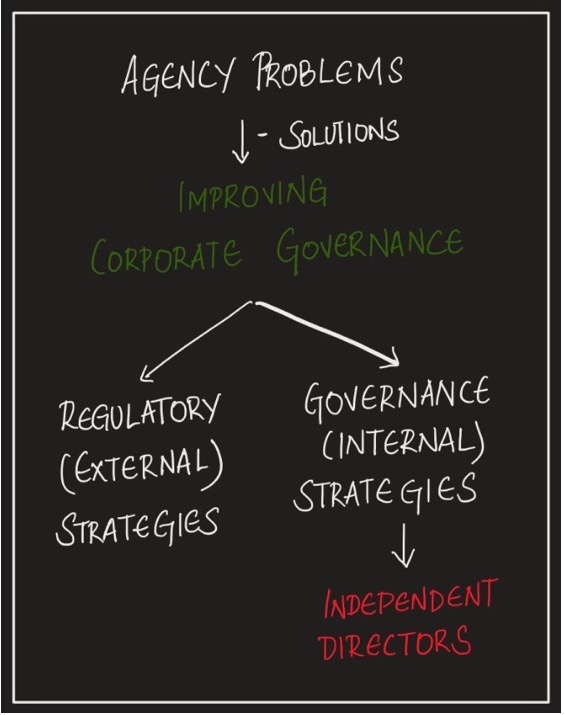

To understand the concept of Independent Directors, we must first understand the concept of Agency Problems. Agency Problem arises when actors of the company who are expected to work for the betterment of the company which in turn translates to the collective betterment of its stakeholders, work for their own self interests. They are put in a position of conflict of their own interest versus the interests of the company. Thus, there arose a need to neutralise this conflict, surrounding which various strategies such as Governance and Regulatory strategies were constructed.

PURPOSE – MISCHIEF AND SOLUTION

There exist three types of conflicts of interest, they are

- Shareholders (Principal) vs Management (Agent) - The agents are expected to work in good faith to betterment of the company in all circumstances, but they rather tend to work for their own self interests.

- Majority Shareholders vs Minority Shareholders –This way an individual/ family/ group of people hold majority of shares in a company though expected to work for the betterment of all the shareholders collectively tend to work for their own self-interest.

- Company vs Third party stakeholders – company management working in its self-interest at the expense of third-party stakeholders.

Strategies such as Regulatory (external) and Governance (Internal) were drawn up as solutions. The former are external checks made by actors foreign to the company such as legislatures, ministries etc in the form of Act, Rules, and Regulations. The latter are internal mandates that help the principal keep a check on agent’s behaviour internally by ensuring transparency. The concept of independent directors was a part of Governance strategies.

INDEPENDENT DIRECTORS – ORIGIN AND EVOLUTION

Independent Directors are the directors external to the company who have no relationship with the company or its actors in anyway. They are appointed to act both as a director and as a watchdog to implement transparency within the company to protect the interest of shareholders.

Note - the committees were formed with the intention of improving the Corporate Governance structure in general. But the table covers only those recommendations that relate to Independent Directors.

Evolution table1 -

| Timeline | Committees and Respective Recommendations in relation to Independent Directors |

|---|---|

| 1999 - 2000 | Clause 49 of listing Agreement (LODR) by Kumar Mangalam Birla. This introduced the concept of

|

| 2000 | Enactment of Sarbanes Oxley Act in USA (Refined Regulatory Company Law Legislation) |

| 2002 | Naresh Chandra Committee – for defining the role and qualifications of Independent Directors - recommended

|

| 2003 - 2004 | Narayanamoorthy Committee3 – for strengthening Clause 49

|

| 2005 | J J Irani Committee –

|

| 2013 | Major Amendments to Companies Act were made including addition of Schedule IV exclusively for Independent directors. |

| 2017 | Uday Kotak Committee4 – SEBI Committee on corporate governance

|

CRITIQUE6

Though there are several drawbacks this article focuses only the primary critiques are hereby mentioned.

- General Critique of our structure of Independent Director is the direct adaptation of non-localised version of legislation from US and UK. Unlike those countries Indian companies mostly share a common character of concentrated familial shareholding pattern. This shifts the problems from management vs shareholders to majority vs minority shareholders. And the legislation has to be localised to adapt and counter such patterns fails to efficiently address the nuanced problems specific to India.

- One of the specific critiques is an absence of a Standardised Positive Criteria for selection – though clause 49 through its 49(I)(a)(iii)7 and Companies Act through S.149(6) provide for negative factors that invalidate a person from being an Independent Director, but does not provide positive factors, qualifications, or experience necessary for being able to discharge Independent Director’s functions. The required qualification criteria under S.14(6) are left to be set by the management which could be arbitrary. The nomination committee’s recommendation does only have a persuasive value over the decision of the management.

CONCLUSION

Though our corporate government legislations and Independent Director Provisions have come a long way, has its own drawback that need to be amended net for better regulation.

1 N K, “National Committees on Corporate Governance” (Your Article LibraryJanuary 31, 2017) <https://www.yourarticlelibrary.com/corporate-governance/national-committees-on-corporate-governance/99339> accessed April 21, 2022

2 Non Executive directors of directors who not actively involved in the operation of the corporate Institution

3 Chandra N, “Corporate Governance - Mca.gov.in” (Mca.gov.inNovember 1, 2010) <https://www.mca.gov.in/Ministry/latestnews/Draft_Report_NareshChandra_CII.pdf> accessed April 21, 2022

4 Srivastava M, “Analysis of Kotak Committee Recommendations on Corporate Governance - Corporate/Commercial Law - India” (Welcome to MondaqJanuary 3, 2020) <https://www.mondaq.com/india/corporate-governance/875864/analysis-of-kotak-committee-recommendations-on-corporate-governance> accessed April 21, 2022

5 Following are the eligibility criteria as recommended by the Committee to be included in the existing provisions: 1. Specifically exclude persons who constitute the 'promoter group' of a listed entity; 2. Requirement of an undertaking from the independent director that such a director is not aware of any circumstance or situation, which exists or may be reasonably anticipated, that could impair or impact his/her ability to discharge his/her duties with objective independent judgements and without any external influence. 3. The board of the listed entity taking on record the above undertaking after due assessment of the veracity of such undertaking. 4. Exclude "board inter-locks" arising due to common non-independent directors on boards of listed entities (i.e. a non-independent director of a company on the board of which any non-independent director of the listed entity is an independent director, cannot be an independent director on the board of the listed entity).

6 Varottil U, “Hastings Business Law Journal - UC Hastings Scholarship ...” (repository.uchastings.eduJanuary 1, 2010) <https://repository.uchastings.edu/cgi/viewcontent.cgi?article=1152&context=hastings_business_law_journal> accessed April 21, 2022

7 iii)For the purpose of the sub-clause (ii), the expression ‘independent director’ shall mean a non-executive director of the company who: a. apart from receiving director’s remuneration, does not have any material pecuniary relationships or transactions with the company, its promoters, its directors, its senior management or its holding company, its subsidiaries and associates which may affect independence of the director; b. is not related to promoters or persons occupying management positions at the board level or at one level below the board; c. has not been an executive of the company in the immediately preceding three financial years; d. is not a partner or an executive or was not partner or an executive during the preceding three years, of any of the following: i. the statutory audit firm or the internal audit firm that is associated with the company, and ii. the legal firm(s) and consulting firm(s) that have a material association with the company. e.is not a material supplier, service provider or customer or a lessor or lessee of the company, which may affect independence of the director; and f.is not a substantial shareholder of the company i.e. owning two percent or more of the block of voting shares.